Non-U.S. residents in the United States at the time of purchase may ignore this. You may use your foreign passport number in AES (although you can’t open an account yourself).

However, if you reside in the United States and are exporting something (i.e. are being listed as the “United States Prinipal Party in Interest/USPPI” on an export), you must first get an employer identification number (EIN) before filing in AES. Social security numbers are not allowed. This applies even if you are just you, an individual, and are not acting on behalf of a business.

Yes, you have to get an EIN even if an authorized agent or customs broker is filing in AES on your behalf.

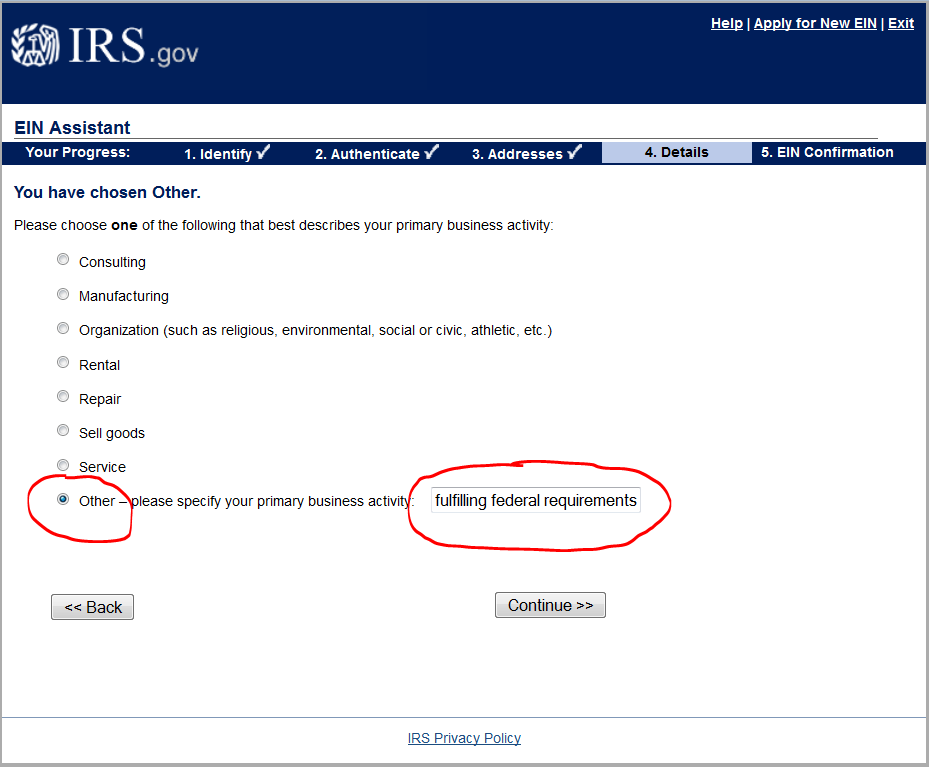

No, this won’t affect your dealings with the IRS. EINs are in fact created by the IRS and are typically used for tax identification purposes, but consider. First, when applying for the EIN as an individual (see below) you will clearly indicate that you are only using this number for “fulfilling federal requirements.” Second, information filed in AES about your export is collected by the U.S. Census Bureau, not the IRS. The Census Bureau, when establishing this rule in 2010 stated that “[u]se of the EIN in the AES is strictly for identification purposes, and information entered into the AES is not disclosed to the IRS.”

The process for getting an EIN as an individual for AES purposes is easy. It takes about 15 minutes online. Here is how.

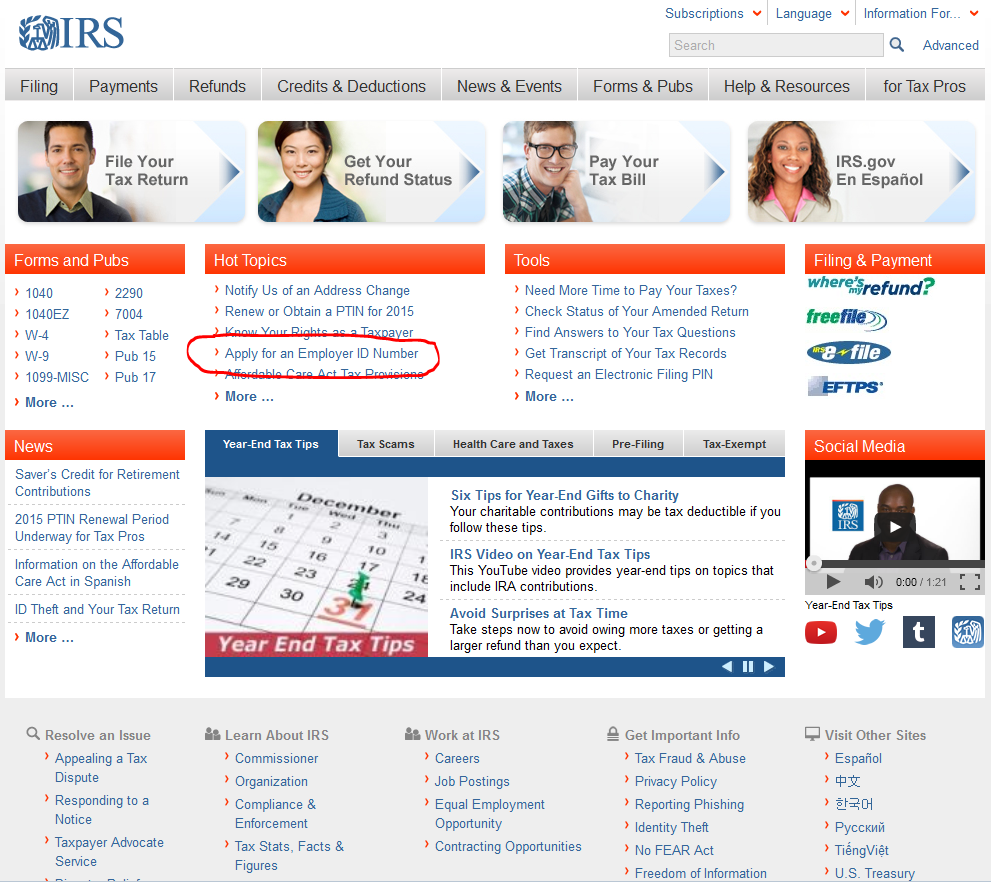

1. Go to the IRS website at irs.gov. Click “Apply for an Employer ID Number.”

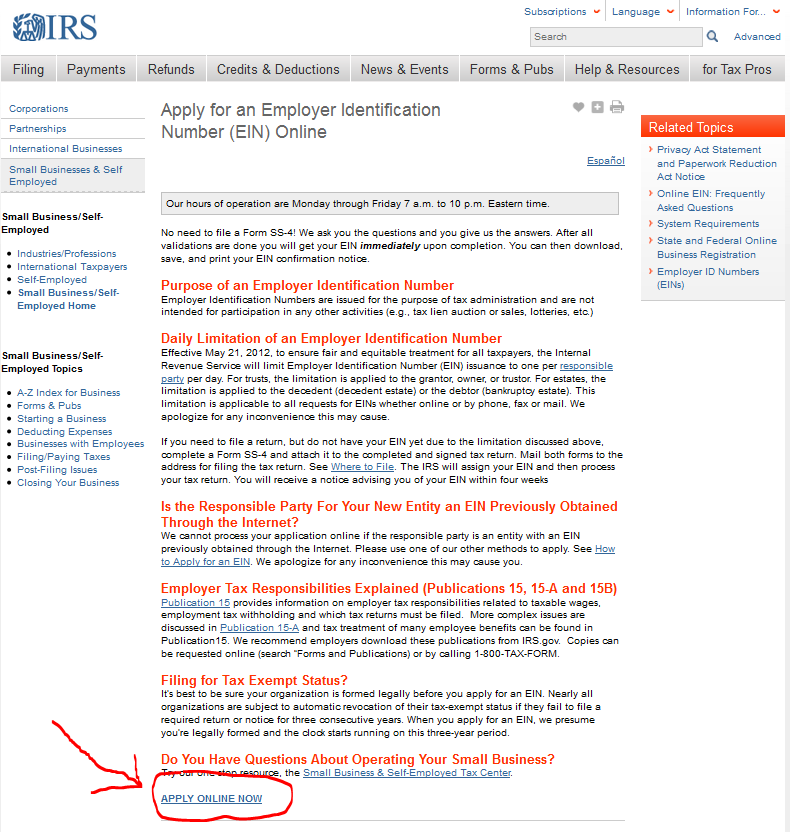

2. Click at the bottom to apply online.

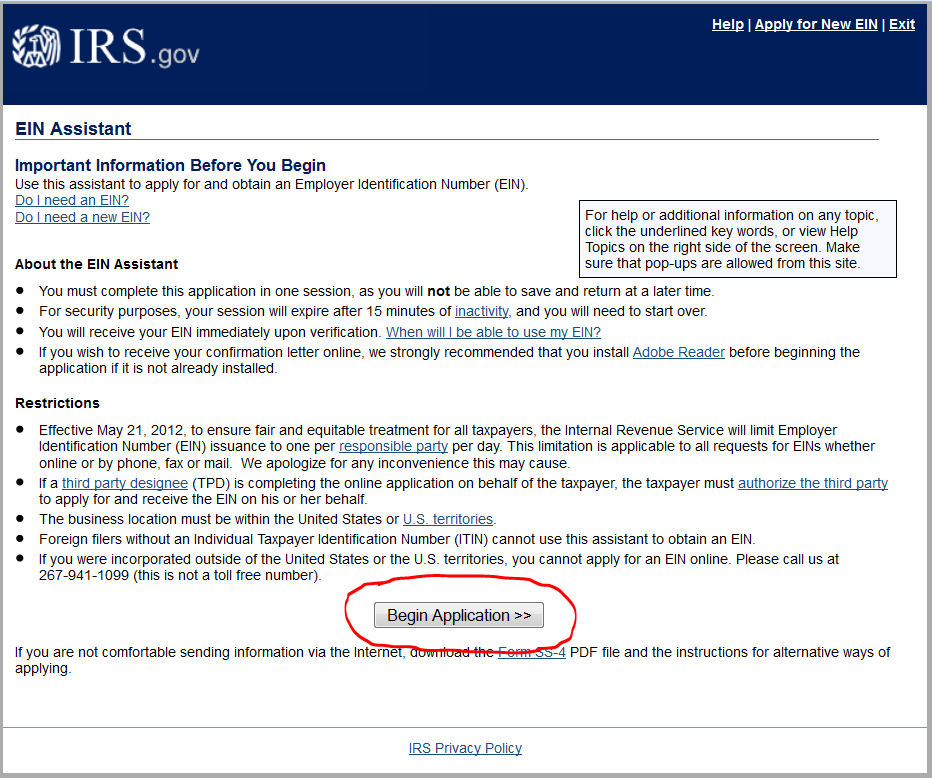

3. Begin the EIN application.

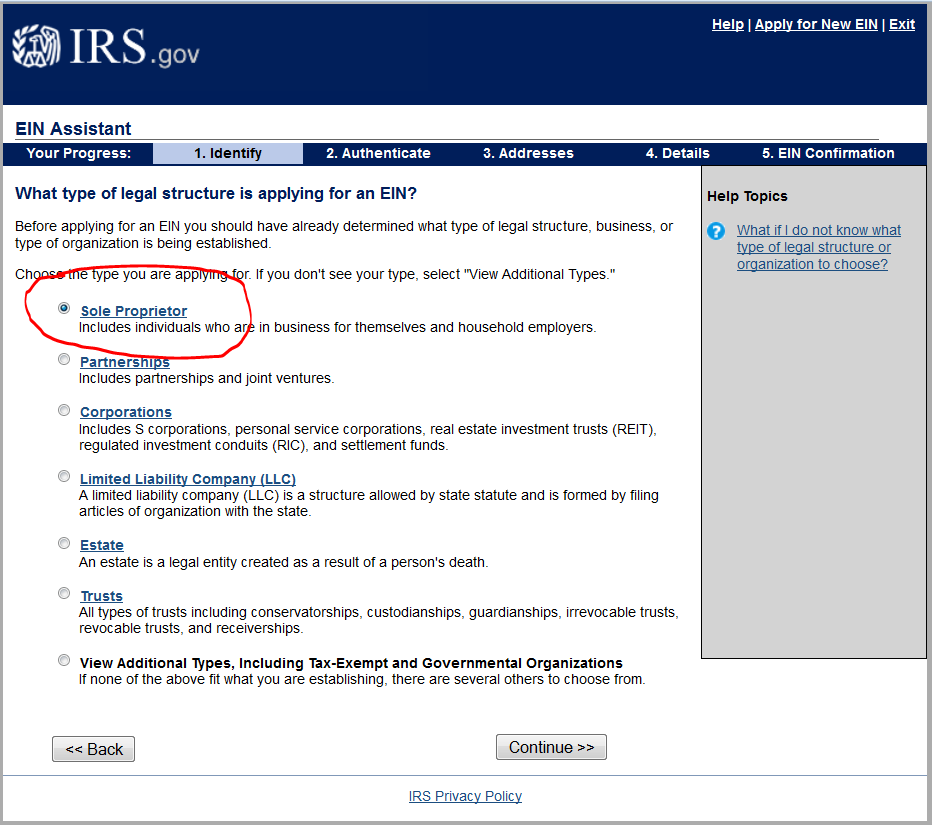

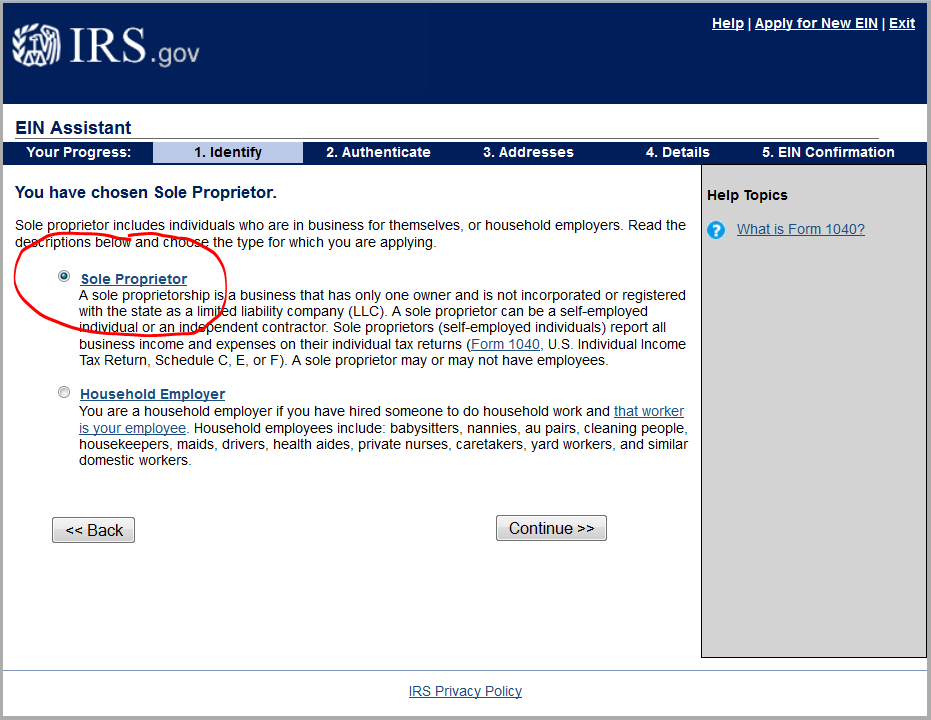

4. Here is a tricky part. You’ll have to choose “sole proprietor” as it the closest thing to an individual.

5. Again, an applicant who is an individual, not a business, will select “sole proprietor.”

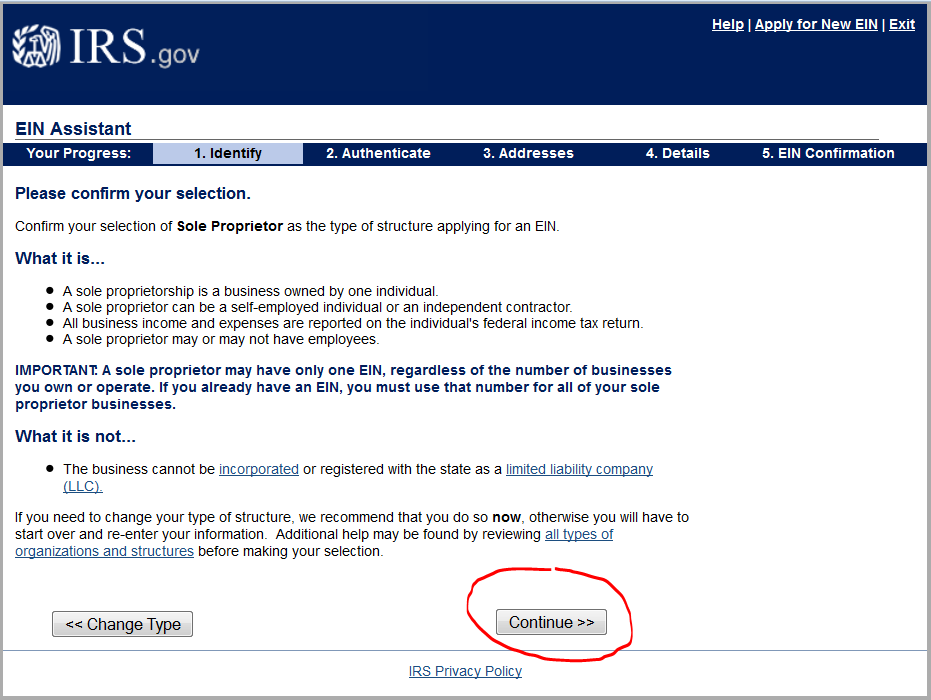

6. Click continue.

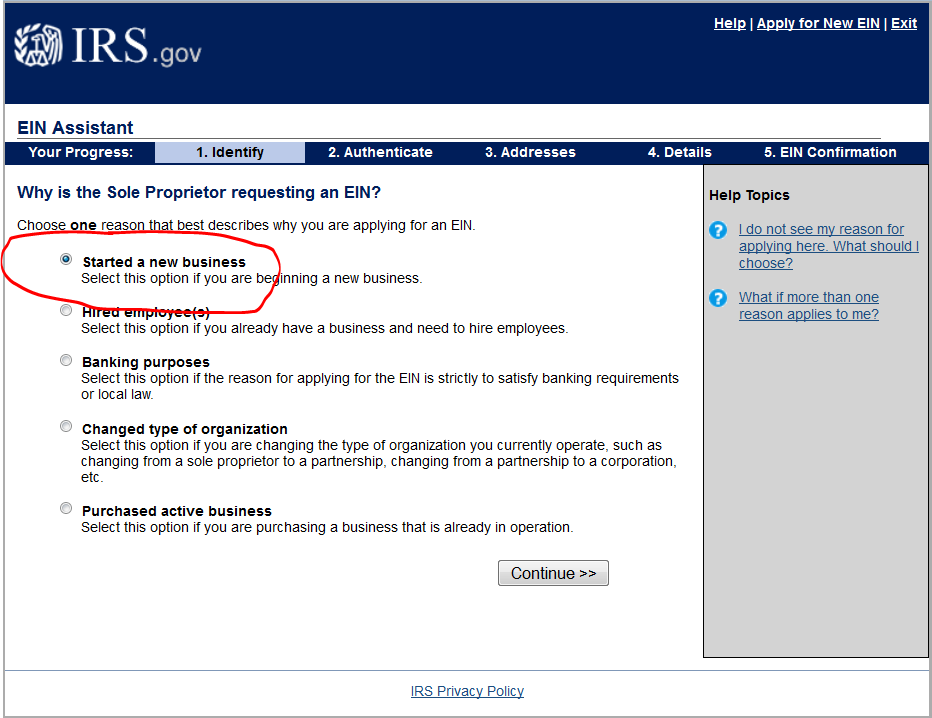

7. Choose “started a new business” as it is the best-fit option for getting an employer identification number, although you may not actually be an employer.

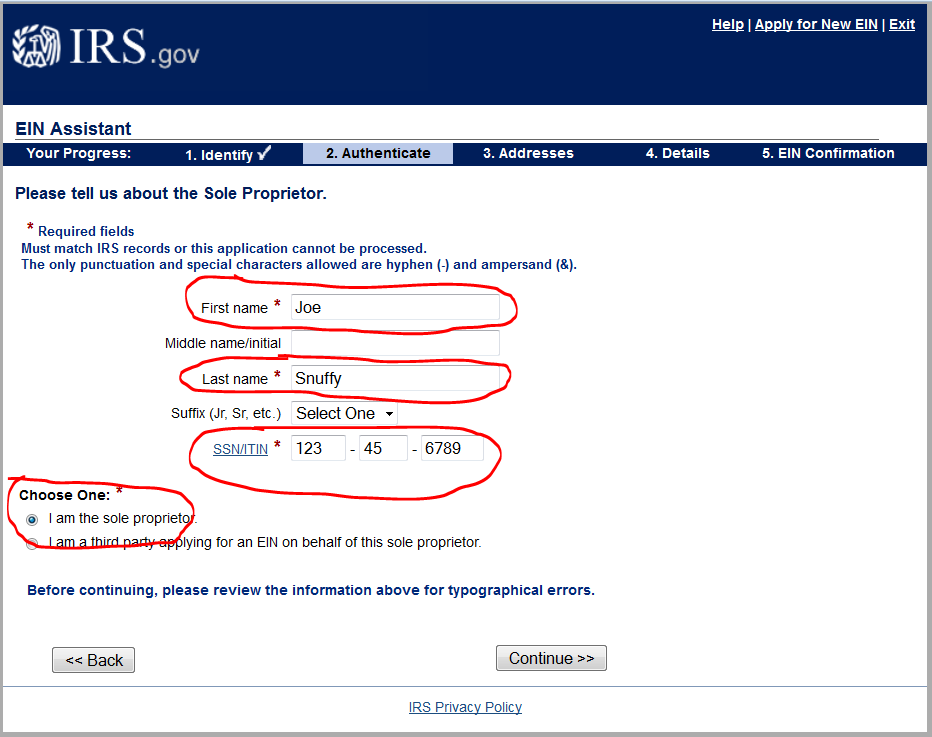

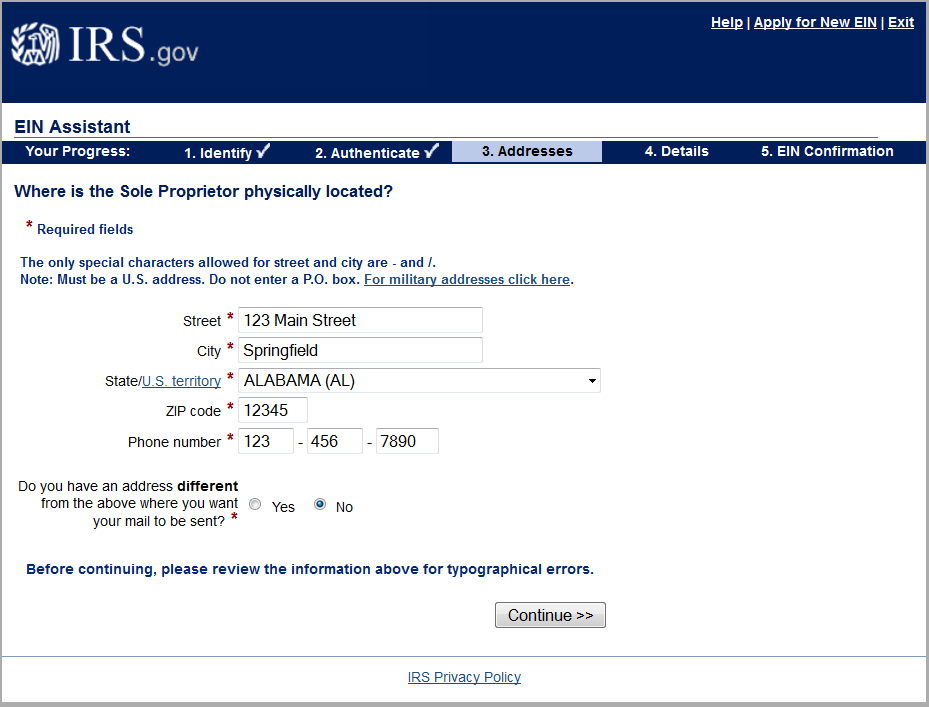

8. The red asterisks (*) indicate required fields.

9. Enter your address.

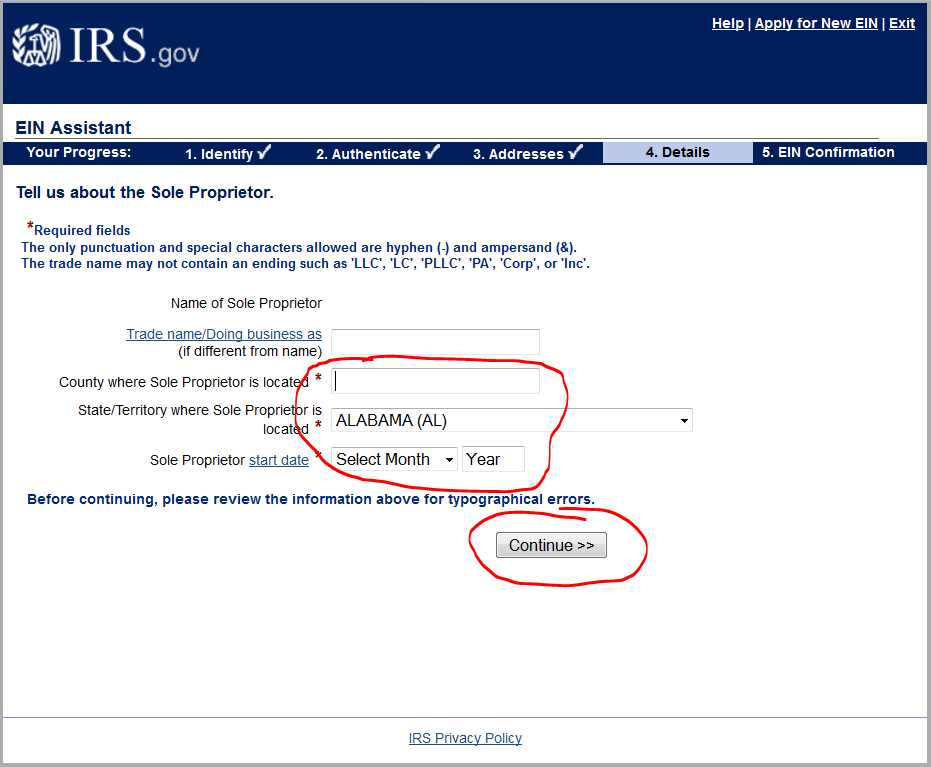

10. Again, note the red asterisks. Your name will automatically appear where it says “name of sole proprietor.”

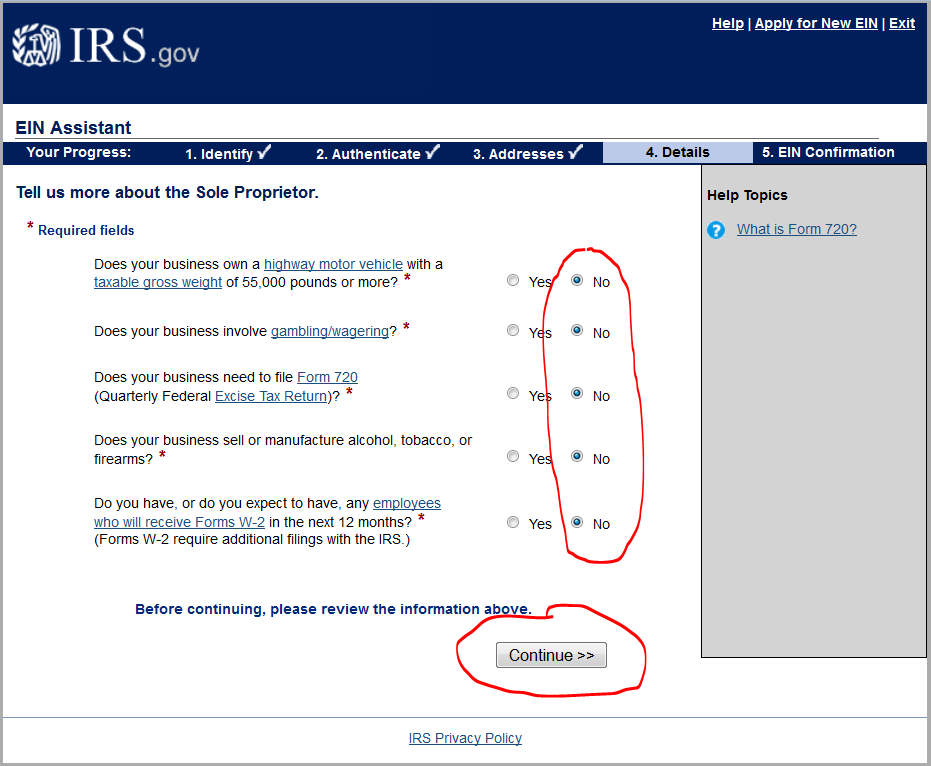

11. None of these things situations apply to you, do they?

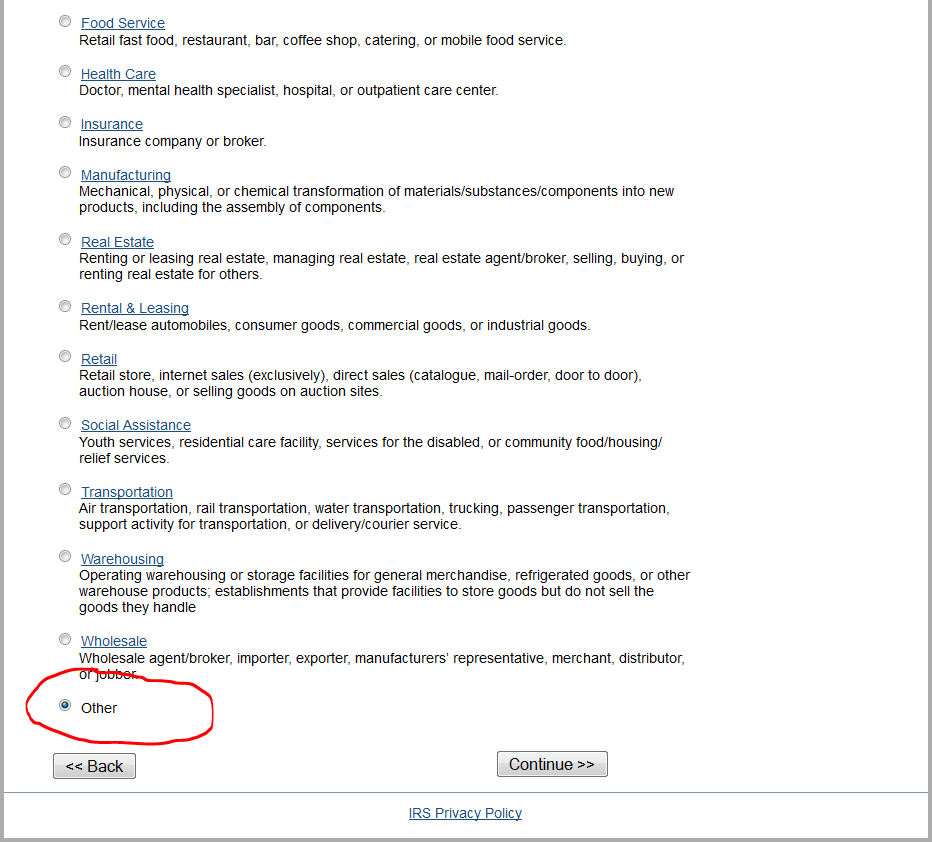

12. Individuals applying for an EIN to file in AES will want to select “other” here. It is the bottommost choice on the page.

13. Select “other” again. Then in the blank space beside it, type in “fulfilling federal requirements.”

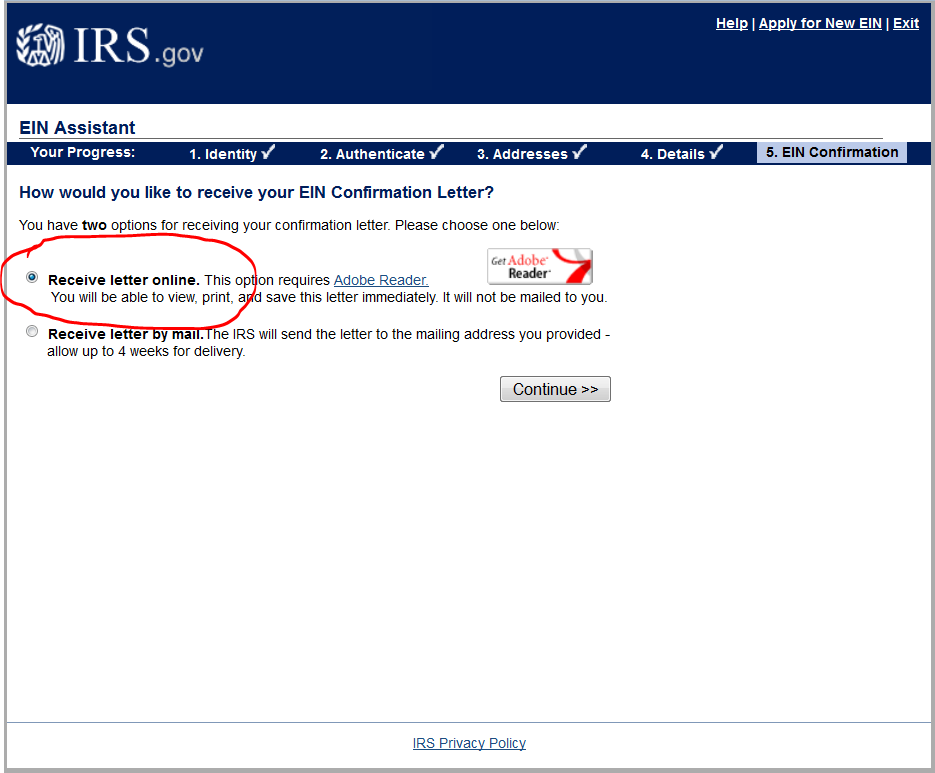

14. If you opt to receive the letter online, your EIN number will instantly pop up on your computer screen.

If you would like a second opinion on how to get an EIN online you may consult these instructions made by the U.S. Census Bureau. It shows an older version of the IRS website.

You now have an EIN and are one step closer to successful filing in AES.